Staking on $ILA- You get what you pay for

As a cryptocurrency investor, no one has not heard the term “Staking”. However, how to choose a profitable project is always questionable. Recently, Infinite Launch has been regarded as one of top leading LaunchPads, which possesses an outstanding Staking mechanism. Let’s discover some advantages and disadvantages when staking on it.

1. Pros

Staking is the process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. On these blockchains, anyone with a minimum-required balance of a specific cryptocurrency can validate transactions and earn Staking rewards which depend on each project’s conventions, typically in the form of additional coins or tokens.

Currently, $ILA is possessing a 10 million dollar-Market Cap, only one-twentieth of other similar LaunchPads such as Seedify, Gamefi or Redkite. The interest rate for staking single $ILA ranks the highest among launchpads on the crypto market, fluctuating between 10% and 90% depending on each type of Pool and holders’ Tier. Besides, the fact that each Tier’s interest rate also varies significantly from 125% to 375% when staking is considered a competitive opponent to other Launchpads.

$ILA is a deflationary token that requires all buy transactions to bear 3% tax out of which 1% to be burnt and 2% to reward investors such as Staking Rewards and Creating Rewards for NFT holders. Thus, it can be said that the number of $ILA tokens is becoming desperately short.

Speculators can choose financial derivatives by holding their stocks for periods of time and employ strategies in order to profit from changes in its price or participate in IDOs rather than staking. Pool Staking contributes to the reduction of Circulating Supply and the increase of $ILA token value as expected. On the contrary, long-term investors will deserve huge profit growth for what they have paid since 3rd month investing.

The fact that $ILA will launch a new APR policy next year along with its sustainable development so far boosts more confidence in holders that Pool Staking is promisingly a fruitful investment strategy.

2. Cons

Turning to the other side of the argument, $ILA somehow is not a tasty “piece of cake” for short-term speculators as users generally only earn rewards after two or three months holding stocks. Nonetheless, they will be offered unlimited withdrawals anytime after the period of 90 days and the high interest on the pools will definitely yield a significant amount of tokens from the 4th month onwards.

At present, there are 3 Pools available on $ILA including Flexible, 45 days and 90 days. Be aware of the 6% transaction fee when you stake & unstake your token.

Pool Flexible - you can conduct withdrawal anytime you want

Pool ILA - 45 days warning: Staking in this pool requires a lockup period of 45 days, you can not unstake your token during this time.

Pool ILA - 90 days warning: Staking in this pool requires a lockup period of 90 days, you can not unstake your token during this time.

Thus, this is absolutely not an expected opportunity for traders who like to "get rich quick".

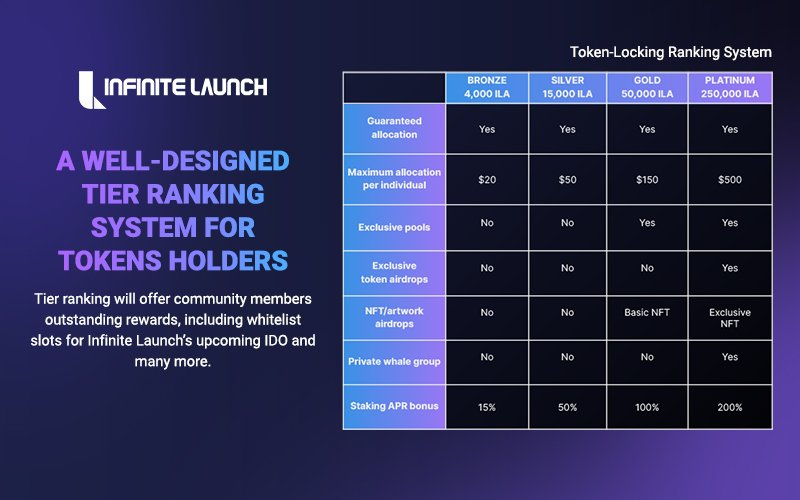

Many ILA holders just prefer to lock the Tier to join IDO without staking, then they miss out on the opportunity to “earn” a large amount of tokens from the high APR interest in the Pools. Infinite Launch divides Staking and Lock Tier into 2 different parts in which Lock Tier is for participants in IDOs, and Staking is for investors who desire to commit to the project in the long term.

This is also a limitation as Infinite Launch needs to attract a variety of captivating projects and achieve good performance listing to increase the ownership demadnand and lock Tier, leading to the increase in the number of users accordingly.

Being a potential Multi-chain Launchpad which owns an intriguing Pool IDO mechanism and provides many top-notch projects for the investors community, the value of $ILA promises to be a prospective gift.