How do The Fed’s decisions affect the crypto market?

What is The Fed?

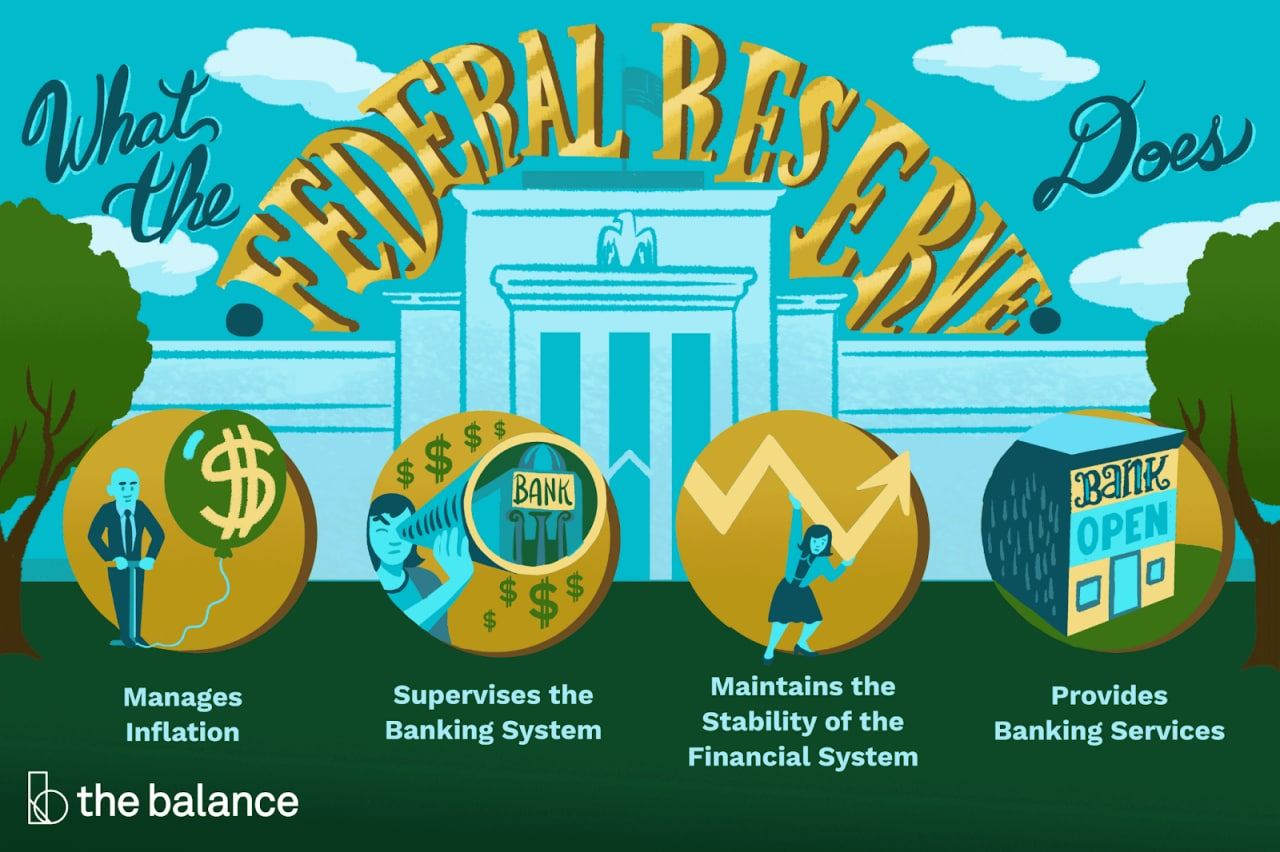

The Fed (Federal Reserve System or Federal Reserve) is the central bank of the United States and arguably the most powerful financial institution in the world.

The organization was established to provide the country with a secure, flexible and stable monetary and financial system. The Fed is privileged to control the production and distribution of money and credit to the nation.

Along with that, The Fed is also responsible for making monetary policy and regulating member banks. The current Chairman of The Fed is Mr. Jerome Powell.

The Fed's Mission

The main objective of The Fed's policies is to create an economy with stable prices (the inflation rate is within the allowable range) and the employment index is at its maximum.

Why do The Fed's decisions have an impact on the global economy?

Every action of The Fed is noticed everywhere in the world.

The reason for this is that the US dollar is the key currency in international trade.

Besides, USD also plays an important part in the international monetary system.

Therefore, the key commodities such as gold and oil are priced in USD.

Meanwhile, The Fed is the only organization that can decide the interest rates of the USD rise or fall, then the Fed can define the value of USD through trading USD and other foreign currencies. This has a direct impact on the strength of the US dollar, affecting the global economy.

In the actions of The Fed, the most notable one is the decision on the interest rates. So what is it?

Learn about The Fed's federal interest rate

What is The Fed rate?

The Federal Funds Rate (FFR) is determined by the Federal Open Market Committee (FOMC), an agency directly under the Fed.

This is the interest rate that banks lend to each other for a day or overnight.

According to regulations, each commercial bank is required to maintain the required reserve ratio at the account of the Central Bank.

Banks that have a reserve ratio below the required reserve requirement of the Fed must borrow more money to replenish.

When the rate exceeds the required level, banks can lend to other banks.

Besides, the Fed interest rate is also a tool used to control the growth of the US economy.

At the same time, it also impacts a lot on other financial costs, including:

- Basic interest rate.

- Deposit interest rates.

- Loan interest rate.

- Credit card interest rates.

- Adjustable mortgage interest rates.

Therefore, any change in the Fed interest rate can cause significant fluctuations in the financial markets, especially the USD.

In view of this, the main goal that the Fed uses this tool is to control inflation, reduce unemployment and ensure stable economic growth.

The FOMC Council usually meet and make a decision in the Fed's interest rate eight times a year.

How The Fed's decision in interest rates affects the markets?

So how does the Fed's decision on interest rates affect traditional markets such as stocks, bonds... and crypto?

The stock and bond market

In general, the Fed's interest rate hike combined with liquidity squeeze also means that borrowing costs will be higher.

If at that time, the economy has not really prospered, this will be a negative thing for businesses.

Therefore, they will have to borrow at a higher cost, thereby reducing profits. This will put some companies in financial trouble. There's a chance the stock market and the bonds would be negatively affected.

However, if The Fed lowers the interest rates, the money supply to the market will increase. This means the borrowing cost goes down.

This decision will contribute to the development of the economy. Especially for businesses, they will have the opportunity to borrow capital at a low cost. From that time they have the ability to grow faster with greater profits.

Although there is no direct impact, the cost of consumer loans will also decrease. This contributes to stimulating consumer demand in society.

In addition, pumping money into the economy may make people hold extra cash. Since then, the amount of idle cash will be generated and the assets many investors choose to invest money in will be stocks and bonds.

All of the above will be a positive for these markets.

Crypto Market

Recently, the correlation between crypto and the US stock market has been increasing.

This means that the reaction of crypto to the Fed's decision will be roughly similar to that of the stock market.

Crypto Market vs Stock Market

Specifically, when the Fed lowers interest rates, thereby pumping money into the economy, crypto will likely be an attractive asset to attract investors' money.

The opposite can also happen with this market.

However, there are analysts who believe that the impact of raising interest rates on BTC is only short-term, even beneficial for BTC.

The reason for this could be that BTC has a finite supply as well as the wider acceptance of the asset.

The effect of Fed’s interest rate decision on BTC price in the past

Let's take a look at how the Fed's interest rate decisions have affected the price of BTC. from the beginning of the year until now.

Specifically, on January 26, the Fed decided to keep the interest rate unchanged at 0.15%. This news initially caused BTC to rise slightly in the first 30p.

However, after that, the price of BTC dropped sharply from above $ 38,000 to $ 35,850.

Over the next few days, the price of BTC rallied back to $41,500.

Nex, on March 16, the Fed raised interest rates from 0.15% to 0.4%. Since the market seemed to have anticipated this scenario, in the first few minutes, the price of BTC fell but rose in the following days.

And the last time on May 4, the Fed raised interest rates to 0.9%, the increase may be said to be stronger than many people expected.

That could be part of the reason why the BTC price rose in the early days but fell sharply in the following days.

From the above data, you can see the opposite reaction of BTC price to the decision on interest rates of the Fed.

This shows that in order to predict the BTC price trend, in addition to the Fed’s interest rate decisions, investors must also consider other factors.